- Return to MAIN WEBSITE

- NORTH AMERICA USA

We understand that carriers are under pressure to grow profitably, continuously develop products, expand in markets, delight customers, and keep pace with technology. Explore our solution and services today.

Businesses have outsourced goods and services for decades, but when insurance carriers seek to outsource their claims, Gallagher Bassett’s Mike Hessling discusses why the evaluation must be far more than a traditional procurement exercise.

Discover new opportunities to drive business productivity, growth and expansion.

Discover our Global Insurance Industry Whitepaper

Gallagher Bassett’s specialist carrier team shares its advice to meet and exceed the challenges and expectations of an evolving insurance industry. Explore five challenges and how to meet them head on.

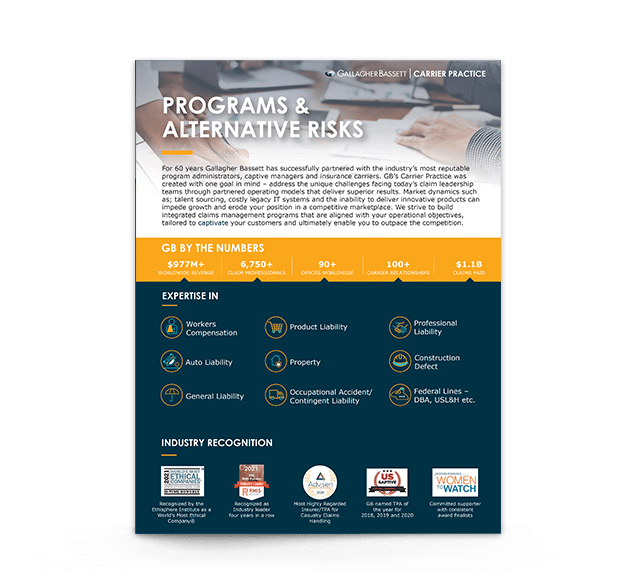

Key strategies to help Program Adminstrators and MGAs stand out from the competition and essential tips on how to achieve successful claims outcomes now and in the future.

Few Third-Party Administrators have the resources or expertise to conquer those challenges, including those created by work-related injuries from a multi-national workforce. In response, Gallagher Bassett has assembled experienced units with the specialized resources and the expertise needed to address the associated risks.

Discover our tailored approach to meet the priorities of mutual and mid-market carriers.

Gallagher Bassett has handled a variety of legacy claims, this allows our partners and their staff to focus on current and future customers, while GB focuses on prior customers. Legacy reserve management is a solution for insurers and companies of all sizes.

Utilizing remote technology to accommodate experts across the country, Gallagher Bassett has put together units that have extensive claims experience in both international and Defense Base Act claims handling. Our multi-lingual staff has over 150 years combined industry experience, with 70+ years handling DBA.

For 60 years Gallagher Bassett has successfully partnered with the industry’s most reputable program administrators, captive managers and insurance carriers. GB’s Carrier Practice was created with one goal in mind – address the unique challenges facing today’s claim leadership teams through partnered operating models that deliver superior results.

You are under pressure to grow profitably, with your attention and capital being pulled in many directions. The need to continuously develop products, expand into new markets, and price competitively are vital to long-term success. How do you create flexibility, while ensuring claims remain a strength for your business?

Insurance carriers and legacy entities have been under pressure to improve

their capital management and operational efficiency for years. This strain has

prompted the strategic reviews of portfolios, particularly in situations where

retaining discontinued or non-core business incurs a disproportionate

amounts of resources.

Step outside the boundaries of traditional claim inquiry and transactional reporting. Learn how to successfully manage all of the applicable risk data and program-specific factors that impact your TCOR with our Luminos hybrid RMIS solution.

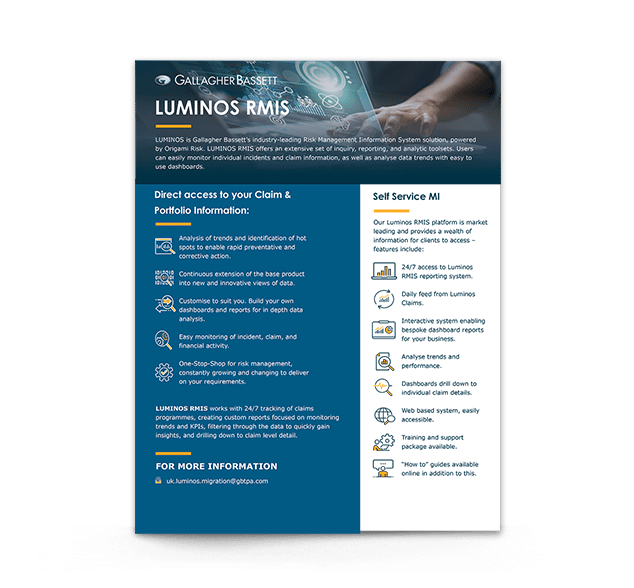

LUMINOS is Gallagher Bassett’s industry-leading Risk Management Information System solution, powered by Origami Risk. Luminos RMIS offers an extensive set of inquiry, reporting, and analytic toolsets.

A leading global equipment manufacturer approached GB to leverage our dedicated legacy claims management expertise and RMIS system to take on their mounting volume of legacy open claims, streamline the run-in claims process.

A GB client since 2017, this national leader in professional lawn care needed a claims and risk management partner that could support its goal of driving sustainable long-term growth.

A client of Gallagher Bassett’s for over 20 years, a large waste hauler organization has seen year-over-year success with its newly implemented subrogation strategy.

In the career of a Risk Manager, few decisions can be as impactful as selecting the right Workers’ Compensation claims management partner. The magnitude of your decision becomes even greater when contemplating moving both existing and new claims to a different partner.

A large international insurance carrier engaged Gallagher Bassett following an acquisition and merger, to build a new outsourced claims and account management function to support rapid projected growth.

Facing a number of unknowns and challenges, GB adopted the client’s preference to utilize a specific liability claims system, while offering expertise and resources to develop a dedicated cost + model that white labelled products and services and met IT-related requirements. The adoption of this new system, mobile apps and intake platforms, qualified resources and streamlining operations, which meant the client was well-positioned to exponentially grow and expand and is set to receive an estimated fee revenue of $20 million at the end of 2020.

A mutual carrier was leveraging various TPAs to handle claims outside of its core footprint in an effort to hasten profitable growth. The carrier was able to compete on a national scale by leveraging GB’s footprint, expertise, and technology. They streamlined oversight by using fewer TPAs and GBs RMIS to easily see and monitor results while being confident GB was delivering an excellent customer experience.

Read how collaborating as partners, claims volume handled by GB for this mutual carrier client increased from hundreds in a few states in one LOB to a national presence in both Workers’ Compensation and Commercial Automobile Liability. This partnership facilitated growth of a differentiated product in a competitive landscape.

An established national insurer’s fixed and allocated internal costs were deemed excessive by the company’s leadership team. GB was engaged to implement an exposure-based staffing model that matched the appropriate adjuster with the relevant files. As a result of GB’s initiatives, the client experienced an upside on fixed costs, improved outcome metrics and established a dedicated team to oversee the transition limiting service disruptions.

Defense Base Act (DBA) niche coverage offers statutory federal Workers’ Compensation and Employer’s Liability Insurance to US Government contractors working outside of the country. Delivering claims management and administration support, GB’s Federal Act knowledge and expertise was critical to ensure a seamless and relevant approach.

Now established as a market leader in the Federal Acts niche, GB continues to help their client grow its DBA profit and portfolio by actively training and providing a dedicated talent pool of DBA claims experts, suited for a tightly regulated and highly competitive market.

Gallagher Bassett undertook the management of portfolios for a global insurer’s Workers Compensation and primary Property and Casualty lines, after identifying two of their legacy systems were set to discontinue. GB oversaw the IT platform migration and created a niche premium tailored product to target a lucrative market segment. By delivering a seamless transition of more than 1000 Workers Compensation claims, GB facilitated a rapid market launch of a differentiated product into a competitive landscape.

A start-up MGA and its carrier partner engaged Gallagher Bassett to initiate and manage the launch of its newest program. After two successful years, the start-up elected to harness their learnings and manage their own in-house team. GB was eventually reengaged to enhance performance and integrate additional improvements for continued growth including exposure-based staffing, policy level data transmission and enhanced compliance with Carrier Practice standards.

Want to drop us a line? You can get in touch by filling out the form below and we’ll get back to you as soon as possible!