Many critical challenges are facing mutual and mid-market carriers, including the pressure to grow, define a clear market position, and attract both customers and talent. The ability to effectively address these challenges will define success in the insurance industry in 2024. But, with multiple priorities, how can you narrow down the key strategic opportunities to focus on?

As we look ahead, we can see four clear drivers for growth in the coming months.

- Investing in Technological Advancements

At a time of technological disruption, it’s no surprise that mutual and mid-market carriers are considering the impact and advantages of these advancements with greater focus. Insurance technology spending is expected to grow by more than 25 percent in the next four years. Conversations with our carrier partners increasingly revolve around the strategic use of technology to enhance processes and gain deeper insights, and how investing in this area, either to improve their internal capabilities or by partnering with a claims handler to access advanced tools and technology, is a priority for 2024.

To keep up with customer expectations, which increasingly revolve around risk management tools and technology-based solutions like Gallagher Bassett’s award-winning RMIS suite, Luminos, technological investment should be at the forefront of a carrier’s strategy for next year. The use of predictive analytics stands out as a crucial component of a carrier’s strategy to anticipate market trends, optimize the customer experience, and make informed decisions. So, embracing and investing in these technological advancements will be instrumental in maintaining a competitive edge.

- Strategic Growth and Expansion

The need to expand into new regions and introduce innovative product lines is evident, yet the current economic climate demands a measured approach to business growth. With this in mind, mutual and mid-market carriers should be strategic in their search for cost-effective, flexible, and scalable solutions that facilitate expansion.

Crucially, finding a partner with a clear line of sight to underwriting opportunities is key to success in 2024. Such partnerships enable mutual and mid-market carriers to identify the most promising avenues for growth, reducing risks, and optimizing their offerings. We are working with carrier partners who are dedicated to distinguishing their services in the eyes of policyholders. Their strategies not only differentiate their offerings but also align with the evolving expectations of their customers.

As we move forward, mutual and mid-market carriers will do well to implement innovative technologies and analyses that can help them gain valuable insight into market trends and customer preferences. These insights serve as the foundation for creating policies that stand out, allowing carriers to move forward confidently and carve a unique niche in the competitive insurance landscape.

- Optimizing the Claimant Experience

Customer-centricity is an essential strategy for mutual and mid-market carriers moving forward. As the insurance market remains highly competitive, mutual and mid-market carriers recognize the importance of placing customers at the core of their decisions concerning products, services, and overall experience, particularly when the reputational impact of a negative claimant experience can be far-reaching.

As customer demands of mutual and mid-market carriers continue to grow, the ability to offer superior service effectively and efficiently, particularly in an industry where products and services may appear similar to customers, will be a key differentiator for all carriers looking to thrive in a dynamic market.

- Attracting and Retaining Talent

Attracting and retaining talent is a persistent industry concern. To address this challenge, mutual and mid-market carriers are prioritizing investment in the professional development and career progression of their existing team members. Such investment will not only enhance the skills of the workforce but also contribute to improved retention rates. Providing a clear and well-defined career path to team members enables claims professionals to envision their further growth prospects and will likely also increase engagement in the long term.

By focusing on these four key areas, mutual and mid-market carriers can position themselves for success in 2024 and beyond.

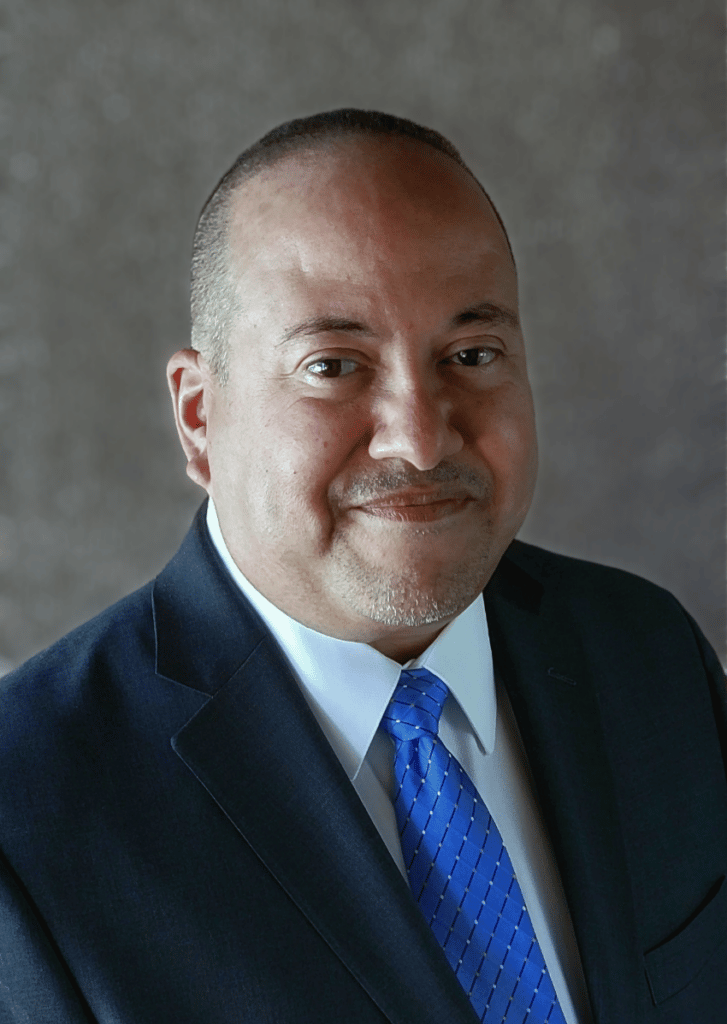

Find out how our dedicated Carrier Practice team can help you unlock growth opportunities, enhance customer experience, and increase talent retention reach out to Joe Berrios or Amy Cooper, VP — Carrier Practice Sales.