The 23rd Annual Target Markets Program Administrators Association (TMPAA) Summit in October drew a record number of more than 1,500 attendees to Scottsdale, Arizona, for the opportunity to network, share ideas, and collaborate with industry peers and prospects.

We caught up with Gallagher Bassett (GB) Carrier Practice team members Amy O’Brien, Caryn Siebert and Jon Stambaugh, as well as Kirsten Mickelson and Doug Betkowski of GB Specialty, to hear their key observations from the event and to get a better understanding of what is driving growth in the ever-evolving MGA, PA, and specialty program space.

Having just returned from the TMPAA Annual Summit, what would you like readers to know about the organization and the state of the program business market?

Amy O’Brien (AO): We are proud to be members of TMPAA and support their initiatives, including this year’s first ever student panel, which GB sponsored. Specialty and alternative markets have been growing in recent years, driven by cyclical and structural factors. Program business continues to be one of the fastest-growing sectors in the P&C industry for the last five years. In fact, the TMPAA’s ninth State of Program Business Study found significant growth in the program business market, with premiums increasing from $67.6 billion in 2021 to $79 billion in 2022.

Caryn Siebert (CS): TMPAA is dedicated to the unique challenges of program specialists, focusing on insurance products targeted to a very niche market, generally representing a book of similar risks placed with one carrier. As an organization, TMPAA now has over 600 member entities, including 360 program administrators and nearly 100 carriers. This was the best attended summit to date, and we see a bright future for the program space as this trend of growth only shows signs of continuing. In addition, the Women’s Luncheon sponsored by Allianz, boasted record attendance, a theme of this year’s event, with nearly 200 attendees.

What were the key trends that your conversations with attendees focused on?

CS: The topic of risk weighed heavily on people’s minds as, in only six months since the mid-year meeting, the industry has experienced and sustained substantial losses. Whether from the increased frequency and severity of natural disasters, emerging cyber threats, the ongoing impact of global conflicts, or socially inflated jury verdicts, macro issues impact reinsurance and pricing, which affects an MGA’s ability to either start or rebrand a program.

AO: My conversations at the conference spanned from traditional lines, including construction, transportation, auto liability, and workers’ compensation, to highly custom lines like cyber, which spans all industries and types of stakeholders. The importance of having a claims management team that understands both traditional and niche exposures, can plan for handling them, and can scale up or down to meet the varying degrees of complexity and volume depending on the incident is vital from a mitigation perspective.

Jon Stambaugh (JS): I agree with the topics Caryn and Amy outlined. These issues resulted in more discussion about the type of risk key players in this space would entertain and the importance of selecting the right business partners. More specifically, cyber was a top concern, confirmed by GB’s Cyber Product Group Leader, Kirsten Mickelson, who was in high demand at our booth throughout the event.

Kirsten Mickelson (KM): More than ever, organizations are dependent on digital capabilities to support their operations and manage data. As one of GB’s subject matter experts on cyber, I spoke with various carriers and MGAs about best practices to qualify for cyber coverage and secure their operations: multifactor identification, endpoint detection and response, dual authentication when wiring funds, and data backup. MGAs especially can manage and highlight the need for both the segregation and segmentation of data. Segregation is taking your critical information offline or away from the internet, while segmentation is splitting it up into little chunks and then storing it separately.

Doug Betkowski (DB): During my time with some of the carriers and MGAs at the event, we discussed the lack of claim resolution predictability, especially when facing various policy demands and unrealistic timeframes, as well as the ways to mitigate negative outcomes. TMPAA provided me with the opportunity to discuss the emerging issues the transportation industry is facing and how the GB Transportation Major Case Unit, a team of seasoned transportation claims professionals who exclusively handle claims files with high incurred value or claims with grievous loss, can help clients navigate automotive claim complexities and overcome these challenges. As verdict amounts increase, medical costs are inflated, and plaintiffs are quicker to file suits, expertise in catastrophic claims management is becoming a requirement.

What topics emerged as primary challenges and opportunities in the specialist space, and how can they be successfully addressed?

AO: More and more, carriers are focused on harnessing the power of their data by prioritizing systems or partnerships that make their data reliable, accurate, and easy to import to actively monitor the profitability and overall health of their program. However, establishing and maintaining the IT infrastructure that supports a business is an expensive and time-consuming investment for carriers. Partnering with a third-party administrator (TPA) that can deliver best-in-class digital experience infrastructure, benchmarking, and dashboard capabilities that provide actionable insights can help carriers grow without the pressure of maintaining, funding, and transforming technological capabilities in-house.

JS: Addressing the complexity and severity of claims continues to be a challenge. Specialty lines written through MGAs and PAs require a specialized claims operation to mitigate their risk. It is not recommended to have generalists handling high-complexity risks, such as professional liability or a major transportation loss where verdicts can reach hundreds of millions of dollars. Instead, PAs and MGAs need experts who specialize in these industries to mitigate severe brand and financial damage.

CS: Recruiting and retaining talent in a tight labor market can create unnecessary time and financial burdens. That’s why access to quality claims management experts with deep technical expertise and flexible staffing to match the ebbs and flows of the business is also critical. I would advise that MGAs and PAs be careful not to compromise access to industry-leading claims talent, even if that means engaging a strategic claims management partner to support business growth and manage complex risks and specialty niches.

How is the rise in AI poised to impact the program space in the future, and how is the industry preparing?

CS: Paolo Cuomo, Executive Director, Strategic Advisory at GallagherRe, provided a fabulous presentation as the closing keynote speaker. His session, “Generative AI and Insurance — How Soon is NOW?” expanded on a topic that we all may soon need to be well-versed in. While many may view ChatGPT and similar consumer-facing applications of AI technology as broadly inconsequential to our industry, Paolo reinforced this is only the beginning. AI has the potential to revolutionize the insurance industry by providing a wide range of services and products and a customer experience that wasn’t possible just a few years ago.

AO: Staying on top of the latest advancements in program management is essential to supporting our clients. Part of our professional growth is the ability to understand the pros and cons of new tools and technology. At GB, we are dedicated to staying on the cutting edge of how AI and machine-learning technologies will affect our clients and how they can be leveraged to reduce errors, improve the customer experience, and optimize insights.

What strategies and approaches are organizations using to attract and retain top talent, and how does this affect the industry?

JS: Given that this sector is poised to exceed $80 billion in written premiums in the coming years (according to the forecasting session), we will all continue to be on the hunt for talent. GB is currently investing in a new internship program, trainee program, and management training programs to ensure we have the talent to support our clients as their business needs grow.

CS: One of the panels that GB was proud to sponsor included five college students considering entering the insurance industry upon graduation. The session, “From Potential to Powerhouse — Developing Emerging Talent,” also included Professor Jackie Wise of St. Joseph’s University, Tandeka Nomvete of the Spencer Education Foundation, Jennifer Guidry of Great American, and GB’s Amy O’Brien. The students were engaged as they discussed how the growth in the program space is very exciting and attractive to insurance professionals.

AO: It was truly an honor and a commitment to the programs space to make this panel happen in partnership with TMPAA. My fellow panelists and I had a lot of fun collaborating on content development. The discussion, along with opportunities for the students to shadow us and attend meetings, was invaluable for them. We truly valued their fresh insight, the questions asked about our industry, and the opinions they shared on key topics.

How can having the right claims partner support the success of a program?

JS: In a competitive, ever-changing market, it is important to differentiate yourself by

delivering a successful claims operation to grow and retain business. While some may choose to handle claims management internally, there is significant value in engaging a strategic claims management partner. Doing so supports enhanced growth when the demands of ongoing compliance, data security, and recruitment can be expertly managed by a TPA. If the TPA has the requisite market expertise, prioritizes quality, is a cultural fit, and can demonstrate that its model drives enhanced outcomes, partnering with a TPA can take a program to the next level.

AO: Selecting a partner with the highest level of expertise in not just the breadth of services but also the industry at hand is critical to ensuring the partnership-building process between MGA and TPA is seamless and delivers an industry-leading customer experience. In this way, MGAs and PAs partnering with GB also mitigate staffing challenges, gain access to a state-of-the-art RMIS platform with best-in-class data analytics, and remove the burden of keeping pace with ever-evolving technology needs.

CS: Given our wealth of industry knowledge, expertise, creativity, and track record of more than 60 years supporting client needs across industries, GB is ready to serve as an extension of the MGAs and PAs looking to expand into new lines, states, and products. Supplementing resources with a partner like GB increases the likelihood of specialists succeeding by strategically managing costs without taking on the burden of fixed expenses.

To learn more about the opportunities for 2024 or to connect with our team of experts, book a free consultation here.

GB at TMPAA

Pictured: Amy O’Brien, Caryn Siebert, and Jon Stambaugh at the Gallagher Bassett booth.

Not pictured but also present: Matt Schauer, Nicholas Gumpel, Sam Terzich, Bob Morris, and Doug Betkowski

Pictured: Amy O’Brien taking part in “From Power to Potential: Developing Emerging Talent,” a panel Gallagher Bassett was proud to sponsor.

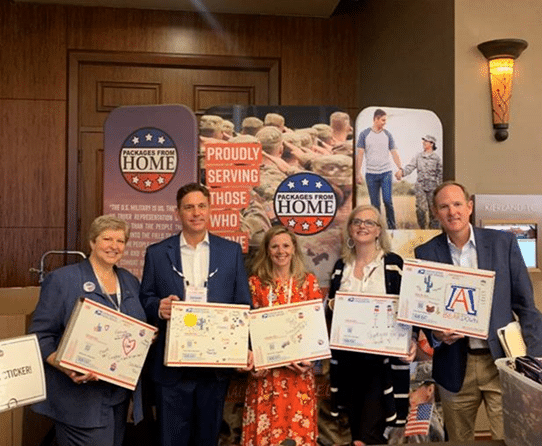

Pictured: Caryn Siebert, Dennis Johnson, Jerilyn Kelly, Julia Houk, Jon Stambaugh, and Kirsten Mickelson taking time to give back with Packages from Home.

Pictured: Caryn Siebert and Jerilyn Kelly attending the Women’s Luncheon.