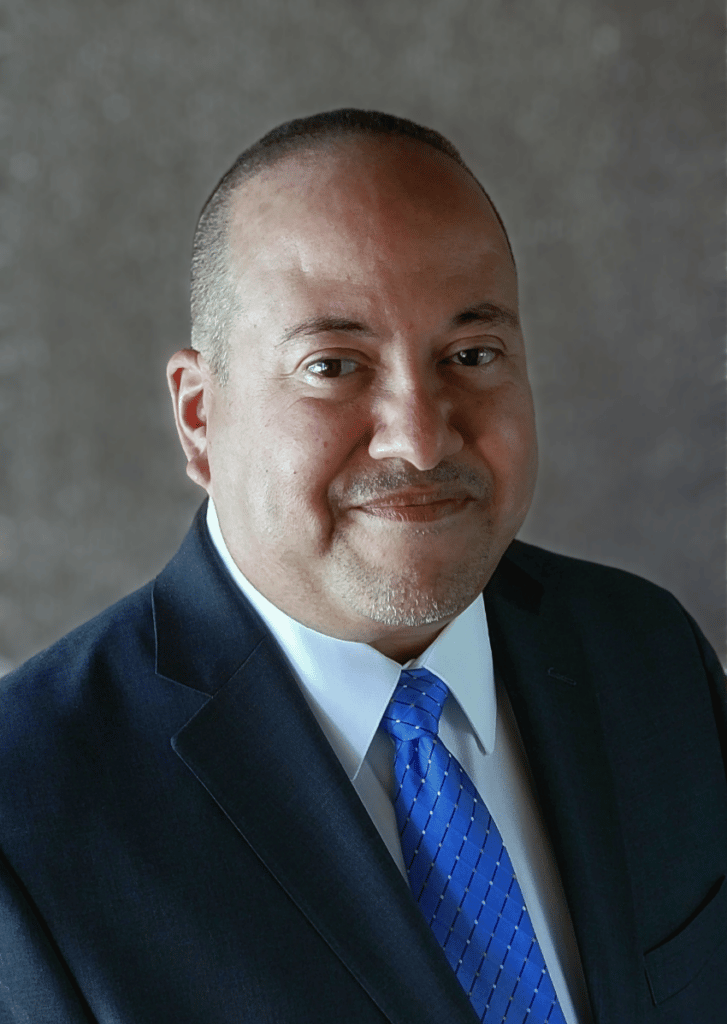

Here are Gallagher Bassett’s Senior Vice President, Carrier Practice, Joseph Berrios, insights into the importance of empathy in the claims process, and how carriers can balance kindness against cost for long-term gain.

- Q) Do you think there’s a need for a consistent approach to managing the customer experience across the industry?

Joseph Berrios (JB) Yes. I believe approaching customers, their employees, and related vendors with an understanding and perspective of their point of view each and every time is critical for maintaining exceptional customer service standards. It’s important to always put the client experience at the center of your work, to understand and meet their needs, and establish trust. At Gallagher Bassett, servicing our clients as an extension of their business and adopting an empathetic approach is critical for providing exceptional service.

- Q) What are customer expectations around the claim experience?

JB) Simply, customers expect claims to be paid promptly and for the service provider to be responsive. They expect to be understood by the provider and communicated with clearly and consistently. It’s important to go beyond expectations by ensuring clear communication with all parties so the uncertainty of the outcomes can be properly managed. Guide the injured party through what to expect during the course of the investigation, coverage verification, determination of exposure, and final adjudication or resolution to prepare them for the journey.

- Q) How important is it to balance empathy against bottom line considerations when dealing with claims?

JB) It’s always important to strike a balance of empathy against bottom line considerations when managing claims. Historically, clients have viewed Resolution Managers or Adjusters as detached, non-empathetic professionals whose primary goal was to mitigate risk and protect financial exposure or loss. Today, during a difficult time of injury or loss, these roles are vital. There’s an important need for the Adjuster to provide support and communication as they guide claimants through a difficult time and help to put lives back together, restoring them to a position where they can move forward post-loss. When someone calls to say they’ve lost everything, insurance adjusters must be ready to handle every call with the calmness, clarity, and attentiveness the situation demands.

The way these communications are handled is just as important as how the company responds. Mental, physical, and financial health can all be on-the-line when something terrible happens, and Resolution Managers should consider the implications of all of these when responding to everything from a nationwide event to an inquiry phone call. Nothing is more important than empathy and proactive assistance during difficult times.

The ability to handle claims proactively and with empathy is critical to customer retention, with recent research finding 90% of clients who receive an empathetic customer experience will return to the brand. Studies now indicate that customer experience makes all the difference and we know insurance consumers expect highly-intuitive and personalized customer experiences, seamlessly integrated sales, and service channels. Better customer experience has been at the top of the insurance agenda for a few years now and the current pandemic has heightened the need for exceptional service in order to secure client retention and promote financial growth.

The hallmark of this superior customer experience is empathy. Balancing the proper use of empathy and understanding can not only positively impact the bottom line for companies but shape your industry reputation.

- Q) What’s the potential cost of empathy – and the cost of not adopting the empathetic approach? (particularly in the COVID climate where client retention is critical)

JB) This is a great question as we now have more studies that show a lack of timely payments, responsiveness, communication, and overall empathy can lead to more costly claim settlements, an increase in unnecessary litigation, and lost clients.

In today’s pandemic environment, there is a greater need for emotional intelligence in the adjudication of insurance claims. This is not a new concept and has been studied well for the past decade. An old J.D. Power and Associates Claims Satisfaction Study cited in the Insurance Journal noted only one in three insurance customers filing a claim report receive all of the top service practices. Among those happy few, satisfaction averaged 919 on a 1,000-point scale, with 85 percent indicating they “definitely will” renew their coverage. This compares to only 21% of customers who received six or fewer service practices saying they “definitely will” renew with their insurer.

- Q) If you could give three pointers on managing the customer experience to every carrier, what would they be?

JB) The three key points to managing the customer experience are:

- Focus on being human – how your customers perceive your company and whether they recommend you and return to you is determined by how your company treats them. These perceptions affect their behaviors, and build memories and feelings to drive their loyalty. A critical way to grow and retain business is to focus on empathy, communication, and responsiveness.

- Virtual doesn’t mean remote – The mobile and virtual environment is quickly becoming the new norm. Carriers should invest in partners who can ensure enhanced client experience, regardless of whether it’s a virtual or face-to-face experience.

- Self-Service Options – key for providing clients avenues for quick access to information, but carriers should also have readily available back-up options for live help and answers to questions that can help avoid frustration or negative experiences. Sometimes the human element with a little empathy can be the difference between retaining a client for a long-term relationship or losing a critical and valuable customer.

- Q) How can carriers be certain that working with a third-party administrator like Gallagher Bassett will ensure their business is protected while their clients are also supported with empathy?

JB) It comes down to having the right systems, people, and processes in place to help our clients reach their strategic vision. We’re committed to being the best at what we do and being able to adapt to any circumstance to make sure the reputation of our client is protected.